- Daily Market Exchange Newsletter

- Posts

- Circle’s $100 billion market cap by 2030

Circle’s $100 billion market cap by 2030

Plus AMGEN and Nikkei Trade updates

Circle’s $100 billion market cap by 2030 By @Ken_CoCo 23.06.2025

Back of envelope calculation for Circle’s $100 billion market cap by 2030:

A roughly $1 Trillion USD stablecoin market (in 2030) x 40% (Circle market share, up from ~25% today)

= $400B in reserve assets

$400B reserve assets x 3% yield = $12B in interest revenue from reserve assets

$12B x 50% (revenue share with Coinbase) = $6B

$6B x 65% operating margins = $3.9B earnings. Yes, I’m assuming Circle’s operating margins would improve dramatically with more scale and assets!

Assuming a 25x price-to-earnings (P/E) ratio: $3.9B x 25 = ~$100B market cap by 2030

If instead, assuming a 30x P/E ratio: $3.9B x 30 = ~$120B market cap by 2030

Here’s how I got to a $968 billion USD Stablecoin market by 2030:

The USD stablecoin market, valued at around $250 billion, facilitates $15-27 trillion in annual transaction volume (depending on the source), versus Visa’s $15 trillion. Dominated by Tether (USDT, $150 billion, ~60% share) and USD Coin (USDC, $61 billion, ~24% share), with others like PayPal USD and Dai comprising ~15%.

Blockchain’s near instant settlement (1-10 seconds vs. days for SWIFT), enables high transaction velocity and reduces token needs for transactional uses (e.g., $10 trillion payments at 150x transaction velocity needs “only” a $67 billion USD stablecoin market vs. $200B at 50x), but holding demand (e.g., savings) offsets this cap.

Likely demand drivers for USD stablecoins in the coming years:

Crypto trading: Stablecoins underpin ~70% of crypto trading volume ($10-$12 trillion in 2025, global market cap $3.5 trillion). Assuming growth to $20 trillion by 2030 (CAGR ~10%-15%, driven by ETF inflows and institutional trading), with 70% stablecoin share and 100x velocity, ~$140 billion in USD stablecoins is needed ($20T × 70% ÷ 100).

Cross-border payments: Stablecoins process ~$2 trillion annually, competing with SWIFT’s $150 trillion at lower fees (<1% vs. 1-3%). Projecting $10 trillion by 2030 (CAGR ~38%, fueled by fintechs like Stripe and banks like Standard Chartered), 50x velocity requires ~$200 billion ($10T ÷ 50) in USD stablecoins.

Remittances: Stablecoins capture ~$10-20 billion of the $800 billion remittance market, with fees ~0.5% vs. 6% for traditional providers. Growth to $150-$200 billion by 2030 (driven by markets like Nigeria and India) at 50x velocity needs ~$4 billion ($200B ÷ 50).

Institutional settlement: Banks (e.g., JPMorgan’s Onyx) and firms like BlackRock use stablecoins for ~$1 trillion in settlements, requiring ~$20 billion USD stablecoins at 50x velocity. Scaling to $5 trillion by 2030 (CAGR ~38%, post-GENIUS/STABLE Acts) needs ~$100 billion ($5T ÷ 50).

Store of value: In high-inflation economies (e.g., Argentina, Venezuela), ~$50 billion in stablecoins are held, with low velocity (5x-10x). Growth to $200 billion by 2030 (CAGR ~32%) requires ~$40 billion ($200B ÷ 5).

In total, $140B USD stablecoin demand from Crypto trading + $200B (Cross-border payments) +$4B (Remittances) + $100B (Institutional settlement) + $40B (Store of value) = $484 billion USD stablecoin demand by 2030.

A 1.5x-2x multiplier for other likely unforeseen use cases (e.g., DeFi, tokenized real estate) adjusts this to $726 billion-$968 billion.

Contemplating a new long-term position in Circle, but a lot of the valuation calculation above depends on Circle achieving at least a 40% market share and its operating margins in 2030!

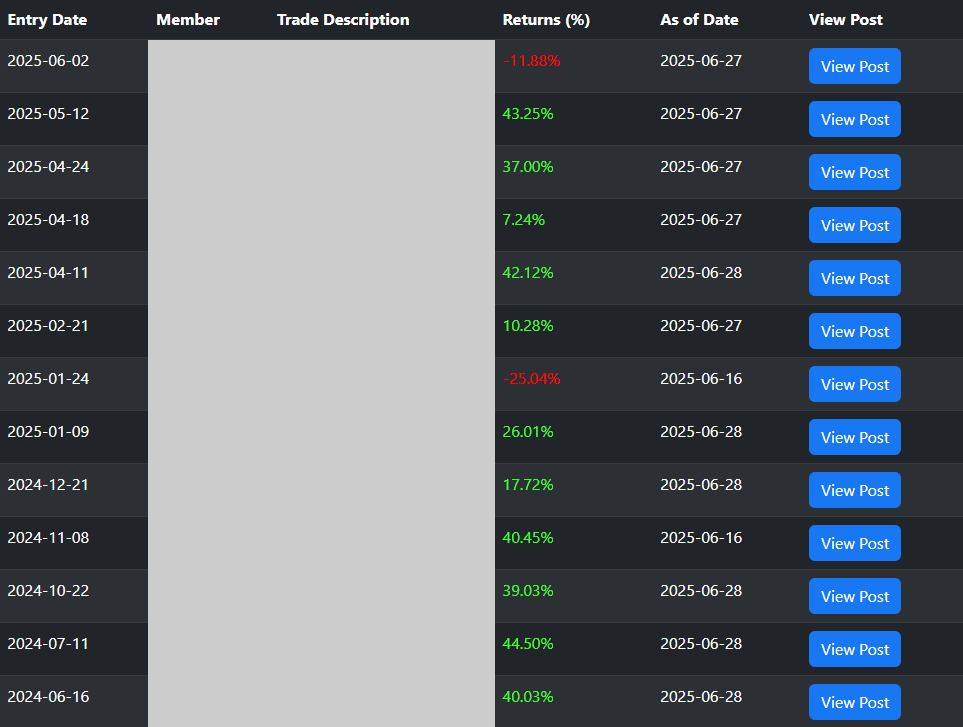

$9.3K trading gains from Japan By @Ben Cap$ 26.06.2025

See the full trade history and updates here.

AMGEN disappoints with latest weight-loss trial data By @Trav.i.am 26.06.2025

See the full trade history and updates here.

Become a FULL ACCESS member today to view all our Current Trades…

For more trade ideas visit the Daily Market Exchange.

Subscribe to receive more Trade Alerts.

About Us

The Daily Market Exchange is a global community where passionate investors and traders share ideas, strategies, and market insights. Stock selection is challenging, and market timing is even tougher—why tackle them alone?

Our members benefit from the collective wisdom and experience of a global network. Unsure about a stock idea? Collaborate with others to refine your research and gain confidence from their sector expertise. Struggling to find fresh trade ideas? Join the Daily Market Exchange today and access our members’ latest analysis and market strategies!

Read more about us HERE.

Disclaimer: The information provided here is for informational and educational purposes only and should not be considered financial, investment, tax, or legal advice. All opinions, analyses, and suggestions are based on publicly available data and general observations, not personalized recommendations. Stock prices, market conditions, and financial outcomes can change rapidly—always verify data independently. Past performance is not indicative of future results, and investing involves risk, including the potential loss of principal.